News and Bulletins

Welcome

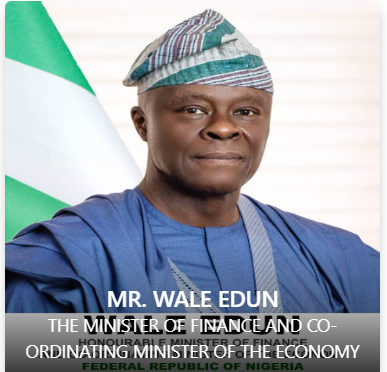

FEDERAL MINISTRY OF FINANCE, BUDGET AND NATIONAL PLANNING

The Federal Ministry of Finance, Budget, and National Planning is the government body that manages the finances of the Federal Government of Nigeria, including managing, controlling, and monitoring federal revenues and expenditures.

Our leadership

Planning

Frequently Asked Questions

Browse through these FAQs to find answers to commonly raised questions.

His Excellency, the President.

Fiscal Policy Department (BOF).

There is also a lot of improvement in our revenue generation. Even though we have not gotten to where we want to be, we have seen steady increase in revenue from 2018 till today, and we expect that trajectory to continue as we implement the strategic revenue and growth initiative. During a Question and Answer session, Mr. Ben Akabueze, Director-General (DG), Budget Office, said: “As the Honourable Minister stated earlier on, the overall budget implementation, expenditure wise as of July, was 92.3 percent. And she pointed out items like debt service, personnel cost performed 100 percent. Capital budget as of that day has reached 60 percent performance and that is what then brought down the overall average to 92 percent. “As of now, every agency of government has received at least 50 percent of their 2020 capital budget released to them. And indeed, despite the challenges of this year, this might be one year we won’t record the highest level of capital budget performance for a while. It is also reflective of the switch to implementing January to December fiscal year, despite interruption of COVID-19.

Ahmed said this recently when she presented to the Federal Executive Council (FEC) the proposal for the 2021 Budget. Before presenting the proposal, she also presented the performance of the 2020 Budget up to July 2020, recalling that in 2020, the government only brought in budgets of 10 GOEs.

According to her: “These 60 GOEs exclude Nigerian National Petroleum Corporation (NNPC) and the Central Bank of Nigeria (CBN) and the reason being that NNPC is a national oil company. Internationally, national oil companies are not included in the national budget. Also, the CBN is an autonomous body. Only those two are excluded, 60 GOEs included. That is to say their revenue and all categories of expenditure are now integrated in the budget.

“We have a total aggregate revenue of N7.89 trillion and also an aggregate expenditure of N13.08 trillion for 2021. There is a fiscal deficit of N4.489 trillion. This represents 3.64 percent, slightly above what is required by the Fiscal Responsibility Act (FRA) of three percent and also to report that the total capital expenditure that is projected in the budget is 29 percent of the aggregate expenditure,” she stated.

Making some comparison, Ahmed said: “This is an improvement over the 24 percent that we had in the 2020 Budget, but slightly below the 30 percent that we targeted in the economic recovery. Just to clarify that the 1.86 million barrels per day (mbpd) crude oil production include 400,000 condensates. So, we have complied with the Organisation of the Petroleum Exporting Countries (OPEC) quota, which is placed at about 1.5 mbpd. So, the 1.46 mbpd is in meeting with the OPEC quota”.

“This is important to us because as you report, if you just report the 1.86, some members of the OPEC appear to think that we are exceeding OPEC quota, whereas we are reporting oil and condensate.

The Federal Government of Nigeria (FGN) has disbursed another round of performance-based grants to States in the sum of N123.348billion (USD324.6million) under its States Fiscal Transparency Accountability and Sustainability (SFTAS) Programme for Results.

The Minister of Finance, Budget and National Planning, Mrs. Zainab Shamsuna Ahmed, who disclosed this in a statement signed by Mr. Hassan Dodo, the Ministry’s Director of Press and Public Relations, yesterday in Abuja, explained that the disbursement followed the achievement of results by the States in the just concluded 2019 Annual Performance Assessment (APA).

The assessment was carried out by the Office of the Auditor General for the Federation (OAuGF) as the Independent Verification Agent (IVA) and approved by the Programme Coordination Unit (PCU) of the Federal Ministry of Finance, Budget and National Planning.

According to Mrs. Ahmed, the disbursement included N91.048 billion (USD239.6 million) of performance-based grants for the 2019 APA results achieved by 32 Eligible States across various Disbursement Linked Indicators (DLIs) covering fiscal transparency, accountability, expenditure efficiency, revenue mobilization and debt sustainability. States received grants in accordance to the number of results achieved, with Sokoto State receiving the highest amount of N6.612billion while Kano State got the lowest amount of N1.710billion.

“Bayelsa, Imo, Rivers and Zamfara States got zero allocation due to their inability to meet the 2019 eligibility criteria which required States to publish online approved annual budgets and audited financial statements within a specific timeframe.” she said.

She further noted that the 2019 APA results were a significant improvement on the 2018 APA results where the total performance-based grants of N43.416 billion (USD120.6 million) were received by 24 Eligible States, demonstrating the substantive progress States have made on fiscal reforms.

She disclosed that the second part of the disbursement involved a new COVID-19 response DLI: The implementation of a tax compliance relief programme for individual tax payers and businesses by States by 30 September 2020 where 34 out of 36 States (only Anambra and Zamfara States missed out) were able to achieve the results for this new DLI for the total of N32.3 billion (USD 85 million) of grants.

The disbursement came after the recent one in November, 2020 by the Federal Government where the sum of N66.5billion (USD175 million) was granted to 35 States which achieved results under another new COVID-19 response DLI: the passing of an Amended COVID-19 Responsive 2020 Budget by 31 July 2020.

The Minister observed that since the first disbursement in April 2020, the Federal Government has thus far disbursed the total sum of N233billion(USD620.6million) to the States under the US $750 million World Bank-Assisted States Fiscal Transparency, Accountability and Sustainability (SFTAS) Programme-for-Results.

Mrs. Ahmed reiterated that the World Bank-assisted SFTAS Programme is principally meant to strengthen fiscal management at the state level so as to ensure effective mobilisation and utilisation of financial resources to the benefit of their citizens in a transparent, accountable and sustainable manner, thereby reducing fiscal risks and encouraging a common set of fiscally responsible behaviours.

She noted that the SFTAS programme could not have come at a better time, given the dwindling government revenue occasioned by oil price volatility and coupled with the current impact of COVID-19 which has further intensified the need for improved practices in fiscal transparency, accountability and sustainability as enunciated in the SFTAS ideals.

Release of funds for the Payment of Salaries/MDAs involves 3 agencies thus: – Expenditure Department issues AI – OAGF cash backs on availability of funds. – CBN pays cash.

You can find the answer on the Ministry’s website: http://www.fmf.gov.ng

Accountant General of the Federation;Distribution by Federation Accounts Allocation Committee (FAAC) and Home Finance Department.

Through our email address Servicom@fmf.gov.ng . We also entertain hand written or typewritten complaint. A complaint must not exceed two A4 pages, which must of necessity to readable, clear and to the point(s).

Investment and Securities Tribunal (IST) and Securities and Exchange Commission (SEC)…

Home Finance Department and Federation Accounts Allocation Committee (FAAC).

Fiscal Measures, Research and Statistics department.

Revenue Department.

Accordion Content Fiscal Measures, Research and Statistics department.

First report to SERVICOM Department/Unit Nodal Officer in charge of the Service Window concerned, if not satisfactorily solved, he can now report to the Ministerial Nodal Officer, Federal Ministry of Finance (FMF) Abuja.

Room 325, third floor SERVICOM Unit, E-mail: Servicom@fmf.gov.ng and Servicomfmf@yahoo.com . If still dissatisfied, Report to the Honourable Minister of Finance through Tel:09-2340932, 09-2336929

Yes. Servicom Unit is a full – fledged federal government’s Service Delivery initiative and Institutionalize service delivery principles to Nigerian public service.

The complaint is analyzed and investigated immediately. SERVICOM Unit reaches out to the service window complained against. If the Unit is satisfied that the service window acted contrary to the servicom work ethics, the unit takes appropriate action without delay.

Yes of course. In case where investigations are concluded in less than 48 hours, the complaint will be reached by phone or other wise he/she will be communicated in writing on the out come of the review within one week.

Through our email address Servicom@fmf.gov.ng . We also entertain hand written or typewritten complaint. A complaint must not exceed two A4 pages, which must of necessity to readable, clear and to the point(s).

These include the following among others: Non-chalant attitude towards providing services, poor services delivery, unauthorized collection demand of cost of services, demand of bribery, withholding of files without an genuine reasons(s), and other form of misconducts.

Fiscal Measures, Research and Statistics Department.