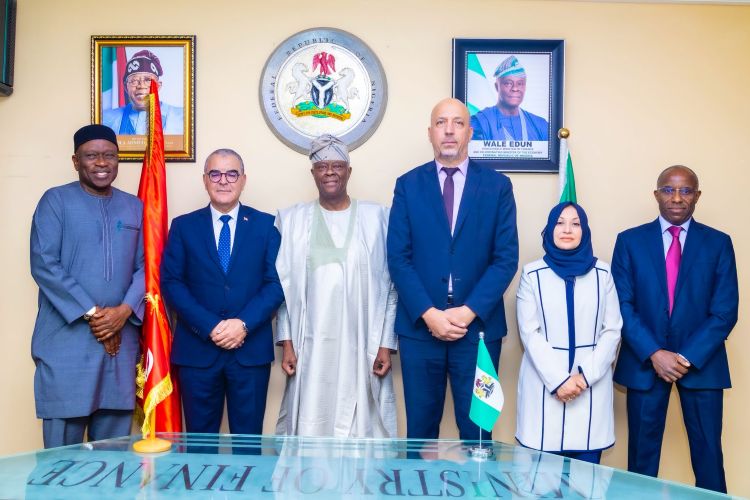

The Niger State Government has presented the Certificate of Occupancy (C -of- O) to the Federal Government for the Sustainable Integrated Productive Communities (SIPC) programme, a landmark initiative combining mass housing, agriculture, renewable energy, and enterprise development to drive inclusive growth.

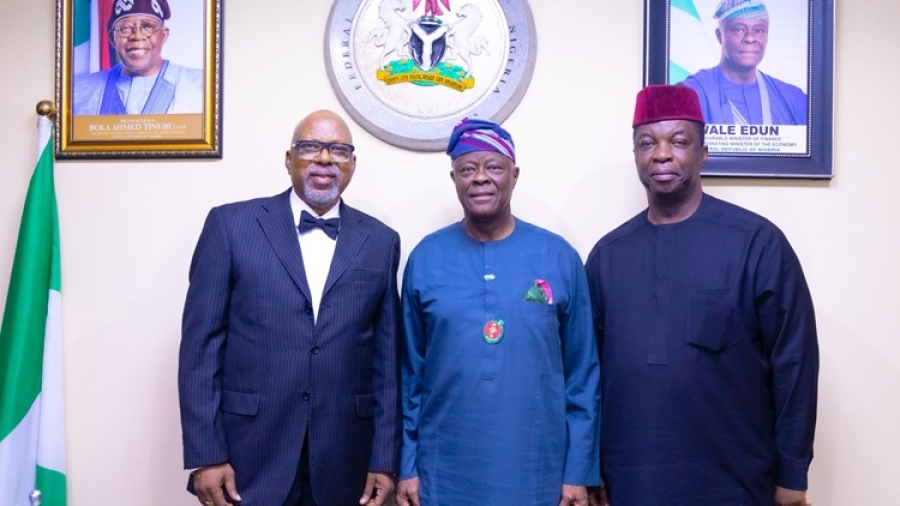

Speaking at the event in her office in Abuja on Thursday, the Honourable Minister of State for Finance, Dr. Doris Uzoka-Anite said the programme is a structured settlement plan for farmers aimed at strengthening agricultural value chains and improving livelihoods.

By anchoring farmers in stable communities with access to basic infrastructure, this project will enhance productivity, reduce post-harvest losses, improve security, and encourage youth participation in agriculture.

She noted that insecure settlements, rural-urban migration, and poor infrastructure have constrained farming communities, and the programme tackles these challenges directly.

The programme goes beyond agriculture, with integrated renewable energy solutions, including solar-powered homes and community facilities, to support agro-processing and storage, while promoting efficient land use, access roads, water supply, and environmentally responsible construction.

Governor Mohammed Umaru Bago pledged Niger State’s commitment to the initiative, citing the state’s land resources and focusing on agricultural development.

This project will bring revolution to Nigeria in terms of industrialisation, agriculture, livestock, security, and more.

He offered 100,000 hectares for the pilot phase and announced plans to give every local government in Niger State 10 tractors with two combined harvesters to assist locals in production.

Permanent Secretary, Federal Ministry of Finance, Mr. Raymond Omenka Omachi assured stakeholders of the Ministry’s commitment to driving policy initiative, transparency, and accountability in implementing the SIPC programme, aligning with the President Tinubu’s vision for sustainable development.

The programme adopts an innovative financing model blending public assets with private investment, promoting sustainability and shared risk.

MOFI’s Managing Director, Armstrong Takang, highlighted the initiative’s focus on ensuring rural communities benefit directly from Nigeria’s land and asset base.

The SIPC programme is positioned to attract developers, financial institutions, pension funds, and agribusiness investors, with Niger State offering 100,000 hectares for the pilot phase.

The Federal Ministry of Finance reaffirms its commitment to supporting state governments in delivering impactful, sustainable development programmes.

Signed:

Federal Ministry of Finance, Abuja

January 22, 2026