On the sidelines of the 32nd Afreximbank Annual Meetings, holding in Abuja, Nigeria, the Federal Republic of Nigeria and the Republic of Rwanda today signed a landmark Agreement on the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income, reinforcing their shared commitment to deepening economic cooperation and facilitating private sector-led growth across Africa.

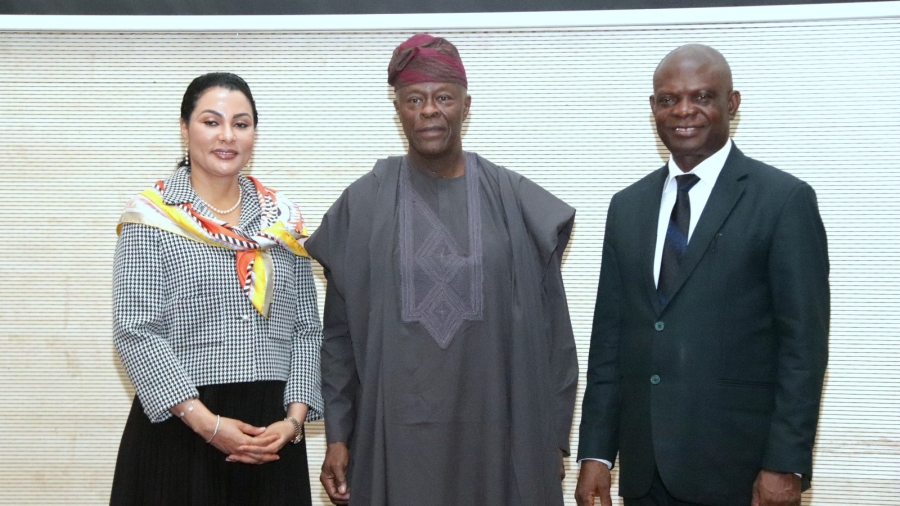

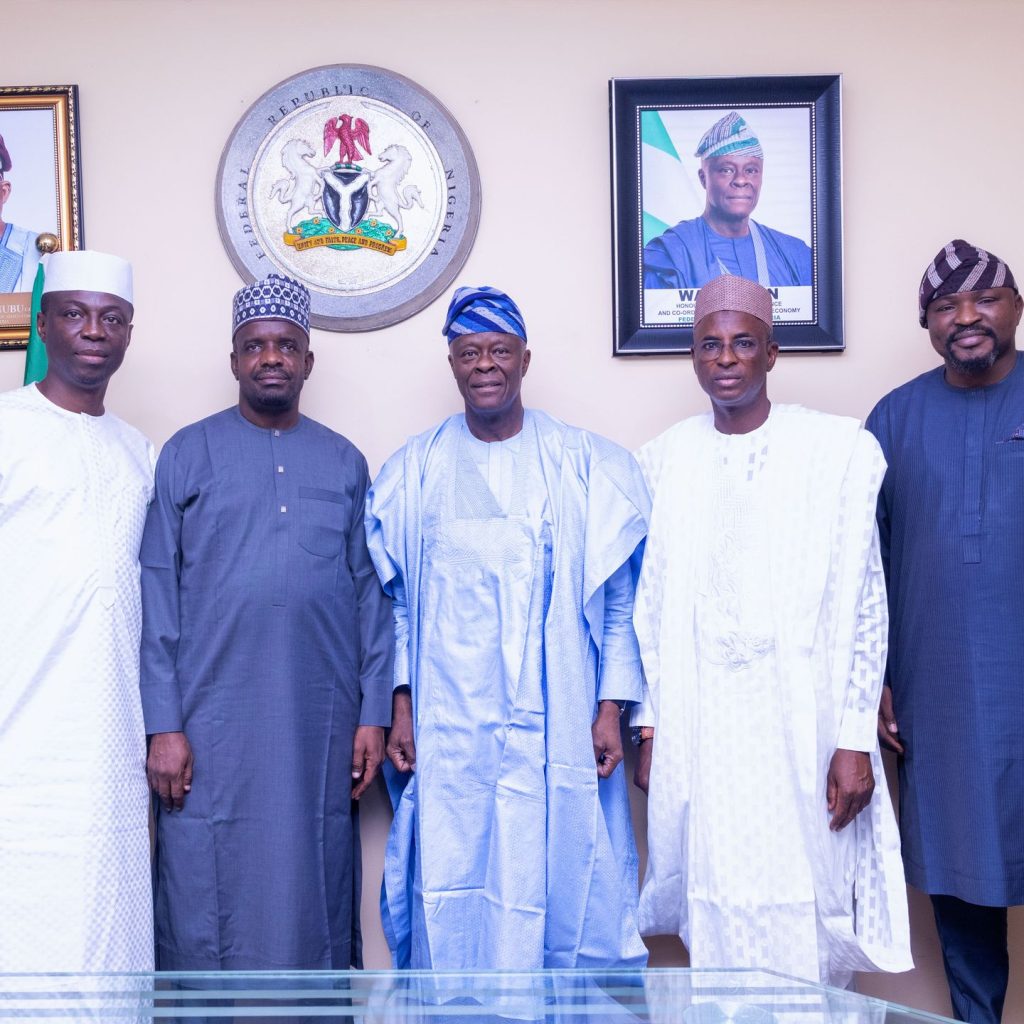

The high-level signing ceremony, held in Abuja, was presided over by the Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, alongside his Rwandan counterpart, Yusuf Murangwa, Minister of Finance and Economic Planning.

HM Edun hailed the agreement as a strategic milestone following the recent passage of four landmark tax reform bills in Nigeria. This agreement is a critical tool for promoting cross-border investment, ensuring tax certainty, and eliminating the risk of being taxed twice on the same income, he stated. Edun added that the agreement supports our broader objective of unlocking private sector capital, accelerating intra-African trade, and positioning Nigeria as a competitive destination for investment under the African Continental Free Trade Area (AfCFTA).

The treaty simplifies tax administration, improves transparency, and aligns Nigeria with global standards, ensuring that both governments can protect taxpayers, reduce loopholes, and combat fiscal abuse. It is expected to bolster confidence among investors operating in both countries, particularly in sectors such as technology, finance, agriculture, and logistics.

Rwanda’s Finance Minister, Yusuf Murangwa, echoed the sentiment of partnership and long-term ambition: This agreement is a testament to the strong partnership between Rwanda and Nigeria, and a critical step in creating a unified, investor-friendly Africa. We believe this will serve as a model for deeper regional integration and shared prosperity.

Both ministers acknowledged the dedication of their technical teams, whose professionalism and foresight shaped the framework for this outcome. The agreement not only cements bilateral tax cooperation but also opens the door for enhanced trade, technology collaboration, and capital flows, laying the foundation for a more resilient, integrated African economy.

As Africa continues to evolve, partnerships like this pave the way for a brighter economic future, fostering growth, investment, and prosperity across the continent.

Signed

Mohammed Manga FCAI

Director, Information and Public Relations

June 27, 2025