In a bid to drive economic growth and development, the Federal Government has taken a significant step by launching the Government–Private Sector (GPS) Dialogue Series: Finance and SME Growth Roundtable in Lagos. This initiative is part of the Renewed Hope Agenda, aimed at fostering collaboration between government officials and private sector leaders to tackle economic challenges and unlock new opportunities.

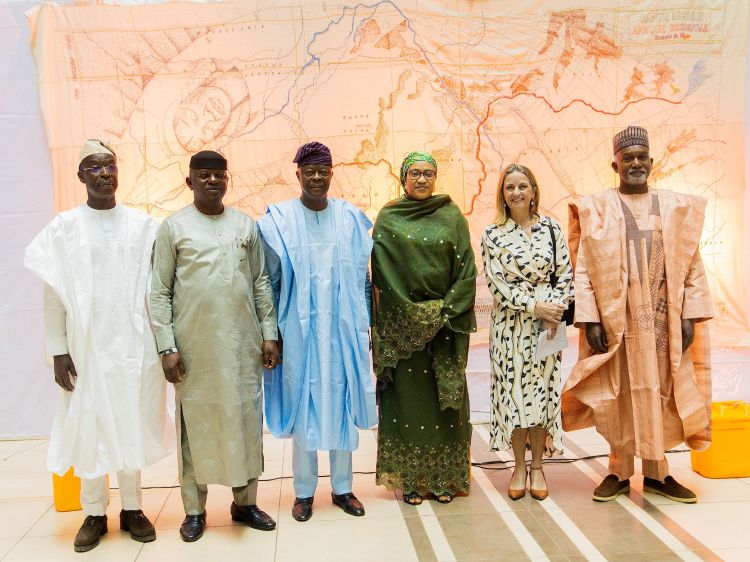

The event, which took place on Saturday at the Radisson Blu, Ikeja, Lagos, brought together key stakeholders to discuss priority issues, identify bottlenecks, and agree on practical next steps to improve access to finance and drive enterprise growth.

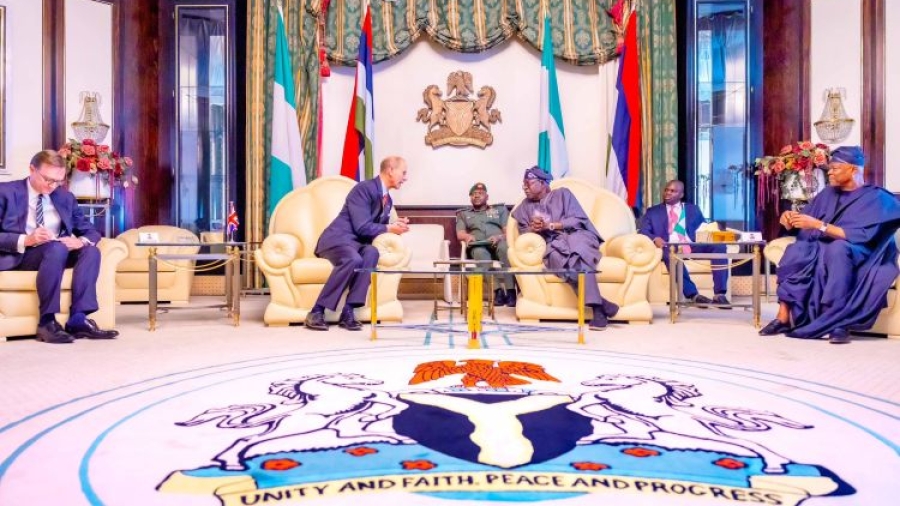

In his remarks, the Honourable Minister of Finance and Coordinating Minister of the Economy Mr Wale Edun assured of the President Bola Ahmed Tinubu Administration’s commitment to creating an enabling environment for all Nigerians to thrive and contribute to the growth of our nation’s economy.

Minister of State for Finance, Dr. Doris Uzoka-Anite in her welcome address stated, The purpose of this series is simple but profound: to bring together Federal and Lagos State officials, private sector leaders, and community representatives to surface priority issues, identify bottlenecks, and agree on practical next steps that will improve access to finance and drive enterprise growth.

Under the leadership of President Bola Ahmed Tinubu, we are committed to creating an economy where enterprise thrives, and entrepreneurs can build and grow their businesses with ease, Dr. Uzoka-Anite emphasized.

The Minister commended President Tinubu’s leadership and vision, noting that His Excellency’s Renewed Hope Agenda has brought a renewed sense of purpose and optimism to the Nigerian economy. His commitment to economic reforms and private sector-led growth is yielding positive results, and we are confident that with the support of the private sector, we can achieve our economic goals.

Dr Uzoka-Anite expressed her gratitude to the Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, for his stellar leadership and tireless efforts in driving the economic agenda of the President Bola Ahmed Tinubu-led administration.

I want to sincerely

commend the Honourable Minister of Finance and Coordinating Minister of the Economy Mr Wale Edun, OFR and the agencies under his leadership for their unwavering commitment to the Renewed Hope Agenda and for working tirelessly to ensure the realization of President Tinubu’s economic vision, Dr. Uzoka-Anite added.

She further extended her appreciation to the Executive Governor of Lagos State, His Excellency Babajide Sanwo-Olu, for his support in ensuring the successful hosting of the GPS Dialogue Series. We are grateful for the Governor’s commitment to fostering a conducive business environment in Lagos State and for his unwavering support for initiatives that promote economic growth and development, she said.

The GPS Dialogue Series is designed to promote inclusive growth, entrepreneurship, and economic development, with a focus on Small and Medium-sized Enterprises (SMEs). The event also saw the announcement of the Lagos-Igbo Consultative Council, a platform for consultation, collaboration, and coordination on issues of mutual interest between the State Government and the Igbo business community.

Dr. Uzoka-Anite further highlighted the administration’s achievements, saying, The unification of the foreign exchange market, the removal of fuel subsidies, and decisive steps to enhance fiscal discipline have sent a clear message to investors at home and abroad: Nigeria is open for serious business once again.

The Minister urged business leaders to see themselves as nation-builders and partners in progress, working together to deliver shared prosperity and drive economic growth. Let us work hand in hand with the administration of President Bola Ahmed Tinubu to deliver the shared prosperity we all desire, she emphasized.

As the Federal Government and private sector leaders come together to drive economic growth and development, one thing is clear: Nigeria’s economic future is bright. With the GPS Dialogue Series, we can unlock new opportunities, foster collaboration, and build a more prosperous nation for all Nigerians.

Signed

Mohammed Manga FCAI

Director, Information and Public Relations

November 1, 2025

www.finance.gov.ng