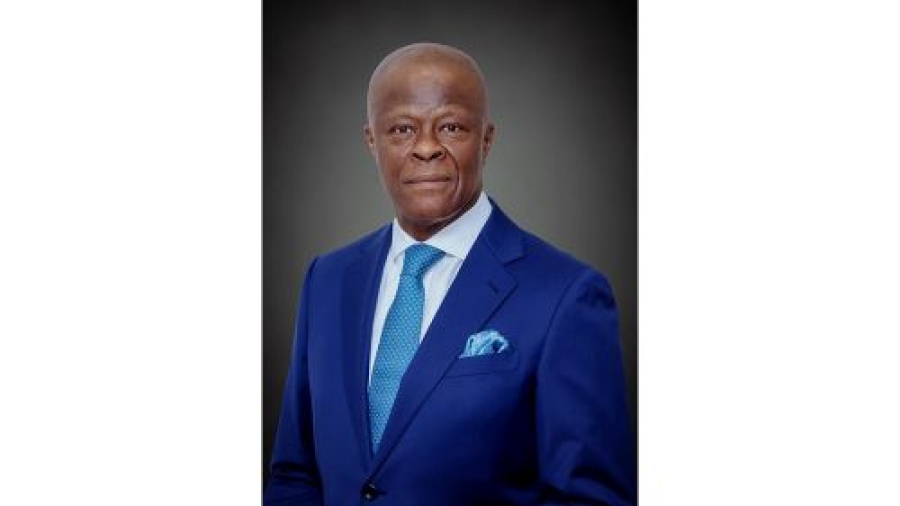

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun today in his office signed the Presumptive Tax Regulations framework, marking a significant milestone in Nigeria’s tax reform journey.

The Minister described the framework as simple, clear and fair, with a focus on economic inclusion, noting that, the reforms aim to protect small businesses and broaden the tax base without raising rates.

He stated that with the signing of these regulations, we are “transitioning from regular to structured implementation of the tax reforms” adding that the regulations provide a simple, increased transparent, fairness, clarity, economic inclusion, consistency and prevention of arbitrary taxation and equitable framework for the administration of presumptive tax, particularly within the informal sector.

“These Regulations according to him are anchored on Mr. President’s commitment to “taxing prosperity, not poverty,”

He highlighted that the Presumptive Tax Regulations introduced a uniform framework for sub-national implementation are designed to:

Exempt nano and small businesses with annual turnover of ₦12 million and below from tax, ensuring protection for struggling entrepreneurs;

Introduce a modest 1% tax on turnover for other eligible informal sector businesses;

Eliminate cash-based tax collection practices by encouraging technology-driven payment systems;

Prohibit the mounting of roadblocks or any informal means of tax enforcement;

Facilitate seamless on-boarding of informal businesses into the formal economy through structured digital platforms.

The Minister disclosed that Nigeria’s economy recorded growth above 4% in the last quarter of 2025, describing it as positive momentum.

He emphasized that the government is targeting 7% GDP growth in the immediate term, as part of a broader strategy to achieve President Tinubu’s vision of a $1 trillion economy by 2030.

He stressed that formalizing the informal sector is central to achieving inclusive and sustainable economic growth. In his words, “We must grow the Nigerian economy across all sectors , micro, small, medium and large enterprises; domestic and foreign investors; and Nigerians in the diaspora. A fair and predictable tax system is critical to that growth,” he added.

The Minister acknowledged the role of the Joint Tax Board in ensuring coordinated implementation across federal and sub-national tax authorities, assuring stakeholders that enforcement would be monitored closely to guarantee fairness and consistency nationwide, and also reiterated that the presumptive tax regime framework will protect small businesses and help them to grow thereby improving the efficiency and fairness of the country’s tax system.

Earlier, the Executive Secretary of the Joint Revenue Board, Mr Olusegun Adesokun said the new rules are meant to put an end to informal coersion and fragmented tax practices, particularly at the sub national level.

He further explained that the “guildlines bans all forms of cash collection by tax authorities”. It also bans the mounting of roadblocks for the collection of taxes, he added.

In his remarks, Mr Joseph Tegbe, the Chairman, National Tax Policy Implementation Committee (NTPIC) said with the signing of these Presumptive Tax Guidelines, we have moved from legal provision to operational reality.

The tax reforms being championed by President Bola Ahmed Tinubu, is not about imposing new burdens but restoring order where there has been fragmentation, replacing arbitrariness with transparency, and building a tax system that reflects the realities of Nigeria’s informal economy while promoting fairness and inclusion he stated.

He emphasized that the National Tax Policy Implementation Committee will continue to work closely with tax authorities to ensure disciplined rollout, operational consistency, and safeguards against arbitrary assessments.

In attendance at the signing were Executive Chairman of the Nigerian Revenue Service, Executive Secretary of the Joint Revenue Board, Chairmen of other Tax Authorities, Sub- Committee Chairmen, Stakeholders and members of the National Tax Policy Implementation Committee.

Signed

Amadi Uloma Nneka

Assistant Director, Information and PR